Cloud-to-Edge Federated Finance Models: Unlocking Real-Time Financial Insights

In the fast-paced world of finance, data drives decisions. Investors, analysts, and companies need accurate, timely insights to make smarter choices — and waiting for end-of-day reports is no longer enough. This is where Cloud-to-Edge Federated Finance Models come in, bridging cloud computing and edge devices to deliver real-time financial intelligence.

Whether you’re a curious reader, a financial professional, or part of your company’s IT or finance team, understanding these models can give you a competitive edge. In this guide, we’ll simplify the concept, explore its applications, and provide practical tips to leverage it for better decision-making.

1. What Are Cloud-to-Edge Federated Finance Models?

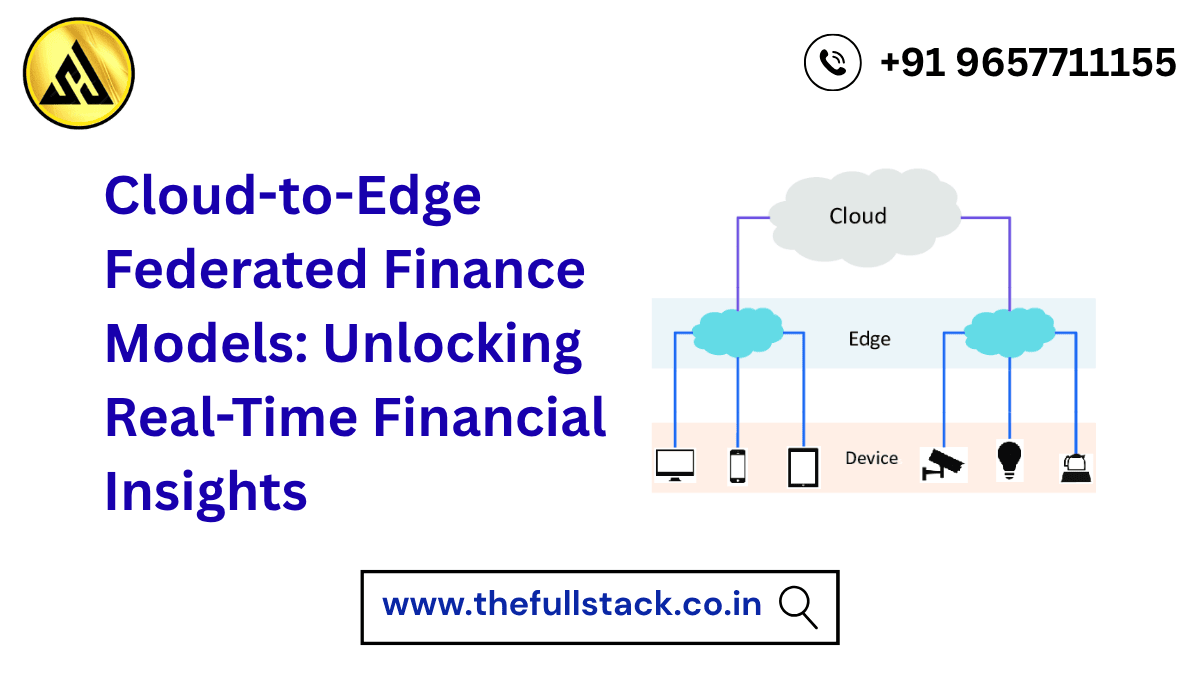

A Cloud-to-Edge Federated Finance Model combines the computational power of cloud servers with the proximity of edge devices (like IoT-enabled terminals, ATMs, or trading devices) to process financial data efficiently.

Federation here means multiple decentralized systems — banks, trading platforms, or regional offices — collaborate to share insights without centralizing all sensitive data. Essentially, it’s about distributed intelligence, bringing analysis closer to the data source while maintaining privacy and compliance.

Key components include:

- Cloud Layer: Handles heavy computations, long-term storage, advanced analytics, and cross-institution modeling.

- Edge Layer: Performs immediate, localized processing, enabling real-time alerts, risk monitoring, and transaction analysis.

- Federated Network: Connects multiple financial entities or branches securely, allowing them to share patterns, models, and insights without exposing sensitive raw data.

2. Why Real-Time Insights Are Critical

In traditional finance models, data is centralized and often analyzed after a delay. This lag can lead to:

- Missed market opportunities

- Inefficient risk management

- Slower response to anomalies or fraud

With cloud-to-edge federated models, organizations can:

- Detect fraud as transactions occur

- Monitor market fluctuations in real-time

- Optimize investment portfolios dynamically

- Enable automated decision-making without compromising security

Imagine a regional bank branch using an edge device to flag suspicious activity while a federated AI model in the cloud updates risk parameters across the network instantly. That’s real-time financial intelligence in action.

3. How Cloud-to-Edge Federated Models Work

Let’s break it down step by step:

- Data Collection at the Edge:

Edge devices collect data from ATMs, trading terminals, mobile banking apps, or market feeds. - Local Processing:

The edge device performs preliminary computations — filtering noise, validating transactions, and identifying anomalies. - Model Training and Sharing:

Federated learning allows local devices to train a shared AI model without sending raw data to the cloud. Only updates (gradients) are sent, keeping sensitive information private. - Cloud Integration:

The cloud aggregates updates from multiple edge devices to refine a global model. This ensures consistency, improved accuracy, and cross-institution insights. - Real-Time Alerts & Actions:

Both the cloud and edge can trigger alerts, execute automated trades, or enforce compliance rules instantly.

4. Practical Applications in Finance

a. Real-Time Fraud Detection

Edge devices flag unusual transactions immediately while federated models refine risk patterns across branches. For example, if multiple locations report similar fraudulent patterns, the cloud model adapts instantly.

b. Algorithmic Trading

Traders can deploy AI models at the edge to react to market signals faster than centralized systems. Federated models continuously learn from global trading trends while respecting data privacy.

c. Risk Assessment & Compliance

Financial institutions can assess credit risk or regulatory compliance locally, then synchronize models across branches. This ensures consistent governance without centralizing sensitive client data.

d. Personalized Financial Services

Banks can offer tailored investment advice or dynamic loan rates in real-time using insights generated at the edge and refined through federated learning.

5. Benefits of Cloud-to-Edge Federated Finance Models

| Benefit | Description |

| Real-Time Decision Making | Faster reaction to market changes, fraud, and risk anomalies |

| Data Privacy & Security | Sensitive financial data remains at the source; only model updates are shared |

| Scalability | Edge devices handle local computations; cloud ensures global intelligence |

| Efficiency | Reduces latency and bandwidth consumption by processing data locally |

| Collaborative Intelligence | Federated learning enables multiple institutions to benefit from shared insights |

6. Industry Trends & Insights

- Increasing Adoption: Major banks, hedge funds, and FinTech companies are embracing federated AI to optimize trading, compliance, and analytics.

- Edge AI Evolution: Modern devices are now powerful enough to run complex AI models locally, reducing reliance on the cloud for every calculation.

- Regulatory Alignment: Federated models help institutions comply with GDPR, CCPA, and other data privacy regulations by minimizing raw data transfer.

- Market Competitiveness: Early adopters gain a strategic advantage through faster insights, smarter automation, and improved client trust.

7. Real-World Example: Edge Intelligence in Action

Imagine a multinational investment bank with trading desks in New York, London, and Mumbai. Each desk uses edge devices to:

- Analyze market sentiment locally

- Detect anomalies in real-time

- Update a federated AI model in the cloud

The global model learns patterns across markets, enhancing predictive trading strategies. If a sudden market swing occurs in one region, all desks adjust strategies immediately, optimizing returns and minimizing risk.

8. Practical Tips for Beginners

- Start with Fundamentals: Learn cloud computing, edge AI, and federated learning concepts.

- Simulate Real-Time Models: Use sandbox environments to test edge devices and cloud integration.

- Focus on Privacy: Understand how federated learning keeps sensitive data secure.

- Iterative Implementation: Begin with a single branch or dataset; expand as models mature.

- Monitor Metrics: Track latency, model accuracy, anomaly detection rates, and real-time insights generated.

9. Challenges & Considerations

- Edge Device Limitations: Processing power may be constrained, requiring optimization of AI models.

- Network Connectivity: Synchronization between edge and cloud must be reliable for accurate global models.

- Complexity: Designing federated finance models involves balancing computation, privacy, and business objectives.

- Security Risks: Federated learning reduces but does not eliminate cyber threats; encryption and authentication are essential.

10. Conclusion: Step Into the Future of Finance

Cloud-to-Edge Federated Finance Models represent a paradigm shift in financial data management and insights generation. They empower organizations to act in real-time, protect sensitive information, and leverage collaborative intelligence across geographies.

For beginners, understanding and experimenting with these models today will position you for financial literacy, operational efficiency, and long-term success in the increasingly digital financial ecosystem.

💡 Take Action Now: Explore our advanced courses on federated learning, edge AI, and real-time finance analytics to build hands-on expertise. The future of finance is real-time — make sure you’re ready.

What is AWS Lambda?A Beginner’s Guide to Serverless Computing in 2025

Java vs. Kotlin: Which One Should You Learn for Backend Development?

Leave a Reply