Serverless Trading Apps with AWS Lambda

The trading world is evolving at lightning speed. What once required powerful servers, costly infrastructure, and complex maintenance can now be managed with a few lines of code—thanks to serverless technology. If you’ve been hearing about serverless trading apps with AWS Lambda but aren’t sure where to start, you’re in the right place.

In this blog, we’ll break down what serverless trading apps are, how AWS Lambda makes them possible, and why this approach is becoming a game-changer for both traders and businesses. Whether you’re curious about finance, just starting your career, or looking to modernize company trading systems, this guide will show you how serverless tech can open new doors to financial literacy and long-term success.

What Are Serverless Trading Apps?

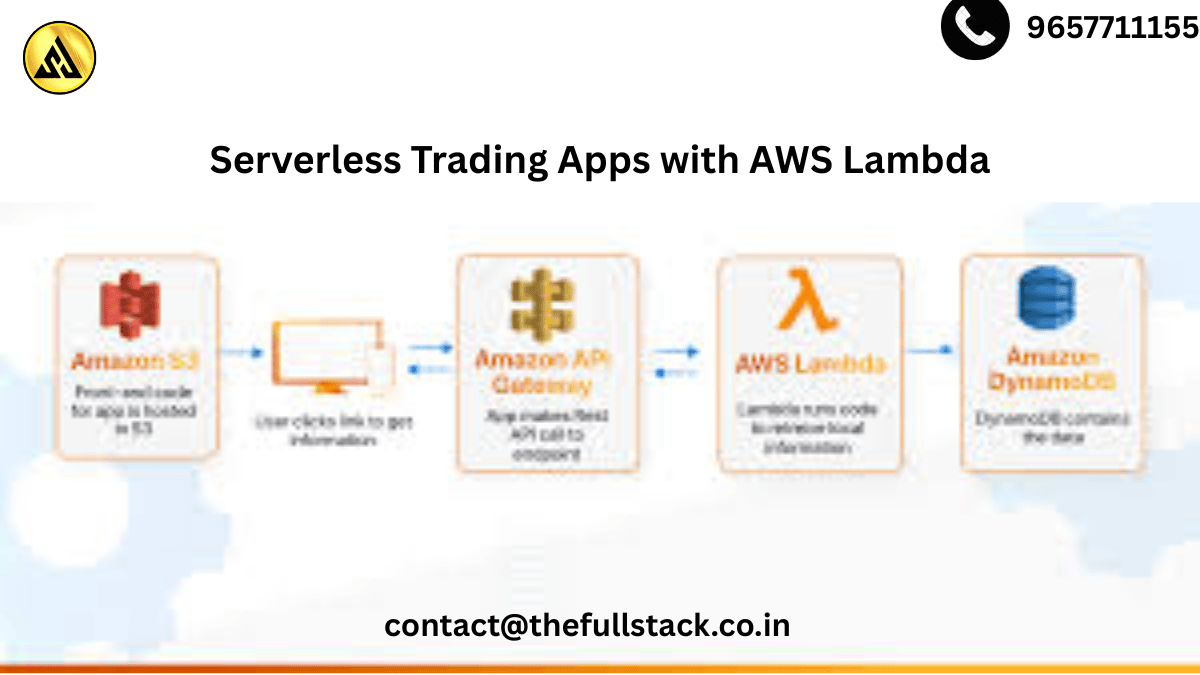

“Serverless” doesn’t mean there are no servers—it simply means you don’t have to manage them. In traditional systems, you’d need to set up servers, keep them running 24/7, and handle scaling when demand spikes. With AWS Lambda, Amazon Web Services takes care of the infrastructure, so you can focus entirely on writing code that powers your trading strategy.

For trading apps, this is huge. Imagine being able to:

- Execute trades instantly when market conditions change.

- Scale up automatically during peak trading hours.

- Only pay for the compute power you actually use.

That’s the magic of serverless.

Why AWS Lambda for Trading?

AWS Lambda is the most popular serverless compute service, and here’s why it’s particularly powerful for trading apps:

- Event-Driven Execution

Trading decisions often depend on real-time data—like a stock price crossing a threshold. Lambda functions can trigger instantly when such events occur, making your trading system responsive and agile. - Scalability Without Effort

During volatile market conditions, trading volumes spike. Lambda scales seamlessly, ensuring your app never misses an opportunity. - Cost Efficiency

Traditional servers keep running (and charging) even when idle. Lambda charges you only for execution time. This makes it especially beginner-friendly, since you don’t need a big budget to experiment. - Integration with AWS Ecosystem

From streaming live financial data (via AWS Kinesis) to storing trading logs (in Amazon S3), Lambda works smoothly with other AWS services to create a robust trading pipeline.

Real-World Applications

Serverless trading apps aren’t just theory—they’re reshaping how companies and individuals trade:

- Automated Stock Trading Bots: Lambda functions can automatically place trades based on predefined rules like moving averages or candlestick patterns.

- Crypto Trading: In the 24/7 crypto market, serverless systems shine because they never sleep and scale globally.

- Risk Management Tools: Businesses use Lambda to monitor portfolio exposure in real time and send alerts when limits are breached.

- Market Sentiment Analysis: Lambda can connect with APIs like Twitter or news feeds, process sentiment data, and feed signals into trading strategies.

Industry Insights: Why This Trend Matters

The global algorithmic trading market is projected to grow steadily over the next decade, driven by demand for faster, more efficient systems. Companies are moving away from heavy infrastructure and adopting lightweight, serverless solutions.

For beginners, this means a lower barrier to entry. You no longer need to be a hedge fund with deep pockets to test and deploy trading strategies. With AWS Lambda, even individuals can run sophisticated systems with minimal upfront investment.

Practical Tips to Get Started

- Learn the Basics of AWS

Sign up for AWS Free Tier and explore Lambda functions. Start small—perhaps by automating a task like sending yourself an email alert when a stock price hits a target. - Understand Trading Fundamentals

Technology is powerful, but financial literacy is key. Brush up on basics like order types (market, limit, stop loss) and simple indicators (RSI, MACD). - Use Demo Accounts Before Going Live

Practice with paper trading platforms to test your Lambda-based strategies without risking real money. - Focus on Security

Trading apps handle sensitive data. Always encrypt API keys, use IAM roles wisely, and follow AWS security best practices. - Think Long-Term

Don’t chase quick wins. Use serverless trading as a stepping stone toward building sustainable, disciplined investment habits.

Relatable Example: Your First Serverless Trading Bot

Imagine you want to trade a stock when its price dips by 5% in a single day. Here’s how you could set it up:

- A data stream (e.g., via AWS Kinesis) tracks live stock prices.

- A Lambda function checks if the price drop exceeds 5%.

- If yes, the function sends a trade order to your broker’s API.

- Another Lambda function logs the trade details in S3.

All this happens automatically—no servers, no downtime, no manual work.

Why This Matters for You

Whether you’re an employee looking to upskill, a student exploring finance, or a company modernizing systems, serverless trading with AWS Lambda represents the future of trading technology. It’s accessible, cost-efficient, and scalable—qualities that level the playing field between individuals and large institutions.

This is not just about trading; it’s about taking your first step toward financial literacy, tech skills, and long-term success.

Your Next Step

Ready to dive deeper? Explore our advanced learning resources and courses designed to guide you from beginner to expert in trading technologies. With the right knowledge and tools, you can start building smarter, more efficient trading systems today.

👉 [Start your learning journey now with our curated courses.]

It might ne helpful:

The Power of Java: Advantages, Features, and Applications

Leave a Reply