Human-in-the-Loop Algo Trading: Where to Draw the Line?

Algorithmic trading—better known as algo trading—has reshaped financial markets. Instead of humans staring at multiple screens for hours, machines now process millions of data points and execute trades in milliseconds. But here’s the big question:

👉 Should humans completely step back and let machines take over, or should there always be a “human-in-the-loop” (HITL) to monitor, guide, and sometimes override these algorithms?

In this blog, we’ll explore what Human-in-the-Loop Algo Trading really means, why it’s important, and where we should draw the line between automation and human judgment. Whether you’re a beginner exploring financial literacy, a curious company employee, or someone interested in the future of markets, this guide will give you the clarity you need.

What is Human-in-the-Loop Algo Trading?

At its core, algo trading relies on computer programs that use predefined rules—such as price, volume, timing, or market signals—to execute trades automatically.

But trading isn’t always black and white. Sudden news events, unexpected geopolitical shifts, or even market rumors can throw algorithms off track.

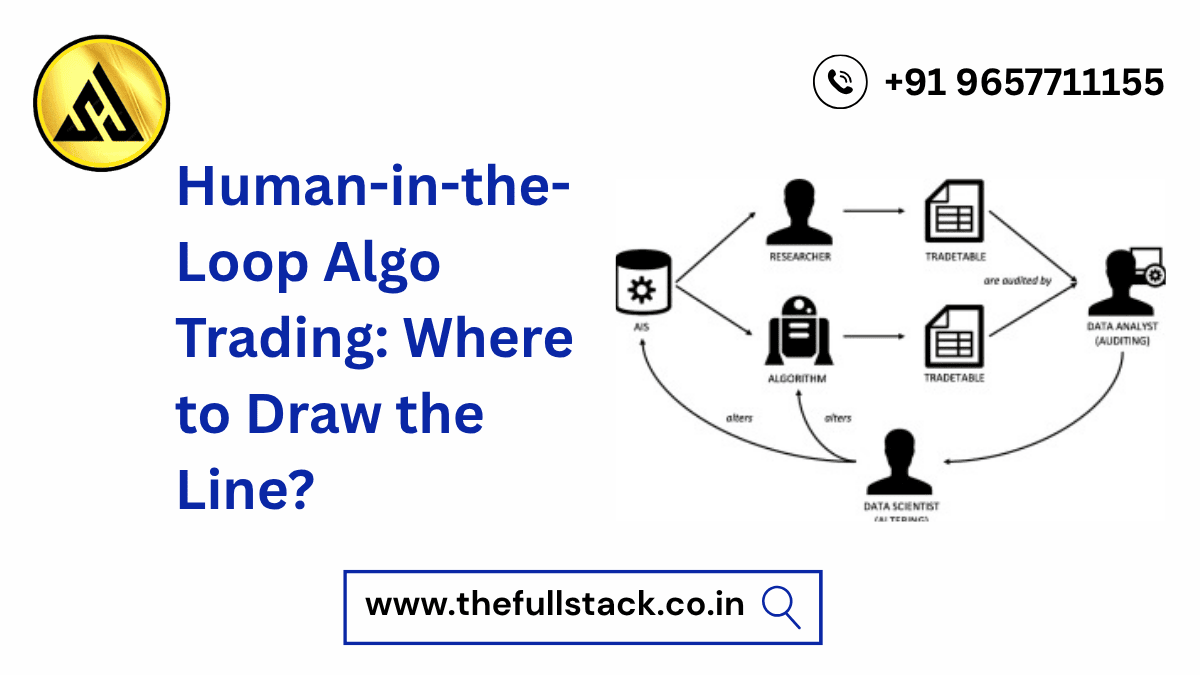

That’s where Human-in-the-Loop (HITL) comes in. It’s a hybrid approach where algorithms handle the heavy lifting of speed and execution, while humans oversee strategy, ethics, and critical decision-making.

Think of it like autopilot on an airplane: the computer flies the plane, but the pilot is still in the cockpit to ensure safety during turbulence.

Why HITL Matters in Algo Trading

Having humans in the loop isn’t just about tradition—it’s about trust, risk management, and responsibility.

Here’s why it matters:

- Risk Oversight

Algorithms don’t “think” about context. A human trader can step in to prevent losses when markets react irrationally to sudden events. - Ethical Safeguards

Certain trades may be technically profitable but socially or legally questionable. Human judgment ensures compliance and ethical responsibility. - Market Stability

Purely automated systems can amplify volatility. Having humans intervene when necessary reduces the chance of “flash crashes.” - Building Confidence

For beginners and institutional investors alike, knowing that humans monitor algorithms creates a sense of trust.

Real-World Examples

- The 2010 Flash Crash: Automated systems caused a sudden 1,000-point drop in the Dow Jones within minutes. Human intervention was needed to stabilize the market.

- COVID-19 Pandemic: Algorithms struggled to interpret the human impact of a global health crisis. Traders had to recalibrate strategies to adapt to unforeseen volatility.

These examples show why a “set it and forget it” approach can be dangerous.

Where Should We Draw the Line?

Finding the right balance between automation and human control is crucial. Here’s how different levels of human involvement look:

- Full Automation

- No human oversight. Fastest but riskiest.

- Best for high-frequency trading with tight risk controls.

- No human oversight. Fastest but riskiest.

- Semi-Automation (HITL)

- Humans approve or monitor trades triggered by algorithms.

- Best for retail traders and institutions balancing speed with oversight.

- Humans approve or monitor trades triggered by algorithms.

- Human-Supported Automation

- Algorithms provide insights and signals, but humans execute trades.

- Best for beginners still learning the ropes.

- Algorithms provide insights and signals, but humans execute trades.

👉 The line should be drawn based on risk appetite, market conditions, and user expertise. For beginners, a semi-automated HITL model is often the safest and most educational.

Benefits of HITL for Beginners

If you’re just starting your trading journey, Human-in-the-Loop systems provide a safety net. Here’s how:

- Learn While You Trade: By observing how algorithms generate signals and then making the final call, you’ll build knowledge faster.

- Avoid Blind Trust: Instead of letting AI trade for you, you stay actively involved in your financial journey.

- Control Risk: You decide how much risk to take rather than leaving it to code.

For company employees, HITL also ensures accountability in trading decisions, making reporting and compliance easier.

Industry Trends: HITL and the Future of Trading

- Regulation is Tightening: Governments and regulators are pushing for transparency and human accountability in automated systems.

- Rise of Explainable AI (XAI): Algorithms are now required to “explain” their decisions, making it easier for humans to step in when needed.

- Hybrid Platforms: Modern trading dashboards combine speed with explainability, giving both beginners and pros confidence in decisions.

The future isn’t about humans versus machines—it’s about humans working with machines.

Practical Tips for Getting Started with HITL Algo Trading

- Choose the Right Platform – Look for platforms that offer explainable AI and human override features.

- Start Small – Use algorithms for simple strategies (like moving averages) before scaling up.

- Understand the Rules – Don’t just copy-paste algorithms. Learn the logic behind them.

- Set Risk Parameters – Decide your stop-loss and profit targets. Let humans approve before execution.

- Keep Learning – Track your trades, note where the algorithm succeeded or failed, and refine your strategies.

Remember: Algorithms are tools, not crystal balls. Your judgment is the final safeguard.

Conclusion: Human + Machine = Smarter Trading

The debate isn’t whether machines or humans should dominate trading. The real power lies in combining both. With Human-in-the-Loop Algo Trading, you get the best of both worlds—speed and precision from algorithms, plus wisdom and responsibility from human oversight.

As you begin your trading journey, remember: automation can accelerate success, but human involvement ensures long-term sustainability.

👉 Ready to take control of your financial future?

Explore our advanced courses and resources on algorithmic trading to gain confidence, sharpen your skills, and step into the world of intelligent investing.

What is AWS Lambda?A Beginner’s Guide to Serverless Computing in 2025

Java vs. Kotlin: Which One Should You Learn for Backend Development?

Leave a Reply