Artificial Intelligence (AI) is transforming the financial sector. From fraud detection to customer personalization, banks are leveraging AI to improve services and make smarter decisions. But there’s a challenge: data privacy. Financial data is sensitive, and sharing it across institutions can be risky.

Enter Federated Learning (FL)—a breakthrough approach that allows banks to collaborate on AI models without sharing raw data. Think of it as training a super-intelligent AI together while keeping everyone’s personal information private.

In this blog, we’ll explain what Federated Learning in global banks is, why it matters, real-world applications, and how beginners and professionals can start understanding this transformative technology.

What is Federated Learning?

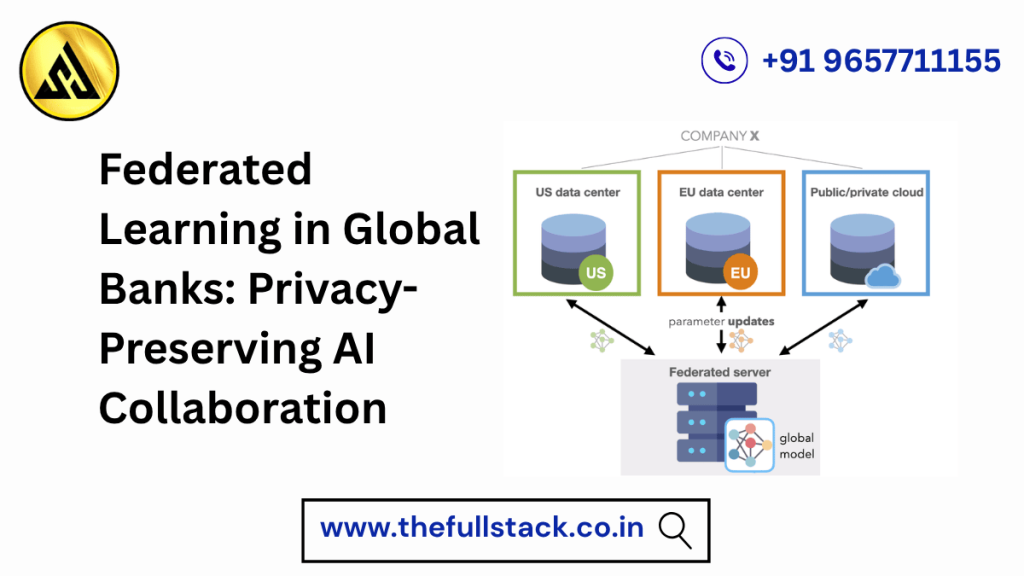

Federated Learning is a method of training AI models across multiple institutions without centralizing sensitive data. Instead of sending your bank’s data to a central server, the AI model is sent to the data location. The model learns from local data, updates itself, and shares only the learnings—not the raw data—back to a central system.

This creates a privacy-preserving loop:

- The AI model travels to each bank’s server.

- It learns from local customer and transaction data.

- Updates are aggregated centrally without exposing individual data.

This method ensures that sensitive financial information never leaves the institution, reducing the risk of breaches while still benefiting from collaborative AI improvements.

Why Federated Learning Matters in Banking

Banks handle millions of transactions daily, from loans and investments to credit card payments. AI thrives on data, but regulatory rules like GDPR and HIPAA limit how data can be shared. Federated Learning bridges this gap.

Key benefits include:

- Data Privacy & Compliance: Sensitive customer information remains on local servers.

- Improved AI Accuracy: Collaborative learning combines insights from multiple banks without exposing raw data.

- Fraud Detection: By pooling learnings, banks can detect fraudulent patterns faster.

- Personalized Services: AI can learn from broader trends while keeping individual profiles private.

In essence, FL allows banks to collaborate safely, creating smarter AI models while staying compliant.

Real-World Applications in Global Banks

- Fraud Prevention – AI models trained via FL can detect unusual transactions across banks without sharing account details.

- Credit Risk Assessment – Banks can refine credit scoring models collaboratively, ensuring more accurate lending decisions.

- Customer Insights – AI learns global spending trends while protecting individual user privacy.

- Anti-Money Laundering (AML) – Federated AI identifies suspicious patterns across institutions without exposing customer identities.

For example, imagine Bank A notices unusual credit card activity in one region. By collaborating through FL, other banks can adapt their models to detect similar patterns without accessing Bank A’s raw data.

Market Trends Driving Adoption

The adoption of Federated Learning in global banking is being fueled by several key trends:

- Rising Privacy Concerns – Customers demand better protection of personal financial data.

- Regulatory Pressure – GDPR, CCPA, and other regulations push banks toward privacy-preserving AI solutions.

- AI Competition – Banks are racing to build smarter models for fraud prevention, risk analysis, and customer personalization.

- Cross-Bank Collaborations – Institutions are forming alliances to share insights safely using FL.

According to industry reports, financial institutions are expected to increase federated AI investments by over 50% in the next three years, reflecting the growing importance of privacy-conscious collaboration.

Benefits for Beginners and Professionals

For Beginners:

- Learn Modern AI Practices – Understanding FL gives you insight into the next generation of AI solutions.

- Confidence in Digital Banking – Knowing that your data is used safely builds trust in AI-driven banking tools.

For Professionals:

- Compliance-Friendly AI – Build models that adhere to strict privacy regulations.

- Collaborative Insights – Leverage learnings across institutions for better decision-making.

- Enhanced Fraud Detection – Detect cross-institution patterns efficiently.

Practical Tips for Getting Started

- Understand the Basics – Learn how federated learning differs from traditional AI and why privacy matters.

- Start with Simulations – Use sandbox environments to see FL in action before deploying it in real banking scenarios.

- Focus on Security – Even though raw data isn’t shared, ensure secure aggregation and encryption.

- Collaborate with Experts – Work with AI engineers, data scientists, and compliance teams for safe implementation.

- Stay Updated – Regulations and technology evolve rapidly. Keep learning about new FL techniques and tools.

Relatable Example

Think of federated learning like group studying without sharing personal notes. Each student (bank) studies their own material (data), the group shares what they learned (model updates), and everyone improves without exposing private work.

Similarly, banks improve AI models collectively while keeping sensitive financial data private.

The Future of Federated Learning in Banking

The future points toward global AI collaboration with zero compromise on privacy. Expect:

- More cross-border banking collaborations using FL.

- Integration with Explainable AI (XAI) for transparent, auditable AI decisions.

- AI-driven compliance reporting where federated models highlight risks without exposing client data.

- Personalized banking experiences powered by global insights while protecting privacy.

For beginners, understanding FL is a stepping stone toward grasping the evolving landscape of AI in finance.

Conclusion

Federated Learning is revolutionizing banking by allowing institutions to collaborate securely and innovate responsibly. It addresses the age-old conflict: the need for powerful AI insights versus the necessity of data privacy.

Whether you’re a general reader learning about financial technology or a company employee exploring AI solutions, FL demonstrates that privacy and innovation can coexist.

👉 Ready to explore the future of AI in banking?

Check out our advanced courses and resources on federated learning and privacy-preserving AI to build your knowledge and stay ahead in financial technology.

What is AWS Lambda?A Beginner’s Guide to Serverless Computing in 2025

Java vs. Kotlin: Which One Should You Learn for Backend Development?