Imagine being at the intersection of artificial intelligence and finance — designing the models, systems, and strategies that power tomorrow’s trading algorithms, risk tools, and financial analytics. As companies pour investment into AI-driven financial tech, the demand for AI Finance Engineers is rising fast. If you’re a newcomer — whether a student, career shifter, or company employee seeking new direction — this guide gives you a clear, motivating, and actionable roadmap to break into this exciting path by 2025.

In this post, you’ll learn:

- Why the AI + finance domain is so promising

- Core knowledge areas and skillsets you’ll need

- A phased, practical roadmap you can follow

- Real-world applications and industry insights

- Tips to stay motivated and build momentum

- A strong call to action to explore courses and deeper learning

Let’s begin.

Why AI Finance Engineering? The Big Picture & Market Trends

1. Market Tailwinds & Industry Demand

- Quantitative finance is evolving: Traditional quant models are being augmented with machine learning, reinforcement learning, and deep architectures.

- Fintech, prop-trading, and investment firms are actively hiring talent who can integrate AI into portfolios, trading signals, and risk systems.

- Cost savings & efficiency: AI can help in fraud detection, credit underwriting, algorithmic trading, and compliance, leading to measurable value.

- Convergence of domains: The most valuable engineers are those who can speak both AI and finance — able to frame financial problems as ML tasks and vice versa.

According to several job market reviews, roles labeled as “AI in finance,” “quant ML engineer,” and “financial ML engineer” have seen sharp growth, especially in financial centers and fintech hubs.

2. What Does an AI Finance Engineer Actually Do?

Here are typical responsibilities you might see:

- Build predictive models (stock movement, credit risk, default probability)

- Design algorithmic trading strategies or signal pipelines

- Integrate AI modules into production systems (backtesting, risk calculators, dashboards)

- Work on feature engineering for financial time series

- Collaborate with quant researchers, risk teams, compliance, IT

- Monitor model drift, retrain pipelines, and manage data infrastructure

The key is bridging AI methods with financial domain constraints (e.g. transaction costs, regulatory risk, interpretability).

Key Domains & Skill Areas You Must Master

To succeed, you’ll develop capabilities across multiple areas. Think of your skill stack as layered: foundational → domain → applied → production.

Foundational Layer: Math, Programming & Statistics

- Mathematics & Statistics: Linear algebra, probability theory, statistics (regression, Bayesian inference), time series analysis

- Programming: Python is the lingua franca. Be comfortable with packages like NumPy, Pandas, Scikit-learn, PyTorch or TensorFlow

- Data engineering basics: SQL, data pipelines, ETL (extract-transform-load), handling missing/irregular data

Domain Layer: Finance & Quant Basics

- Financial instruments & markets: equities, fixed income, derivatives, options, futures

- Quantitative finance fundamentals: CAPM, risk metrics (Sharpe ratio, VaR), portfolio theory, factor models

- Market microstructure & transaction costs: slippage, latency, order books

- Time series modeling: ARIMA, GARCH, cointegration, regime switching

Applied AI / ML Layer

- Supervised & unsupervised methods: regression, classification, clustering, anomaly detection

- Deep learning on sequences: RNNs, LSTMs, transformers adapted for financial series

- Feature engineering & selection: embeddings, autoencoders, domain-aware features

- Reinforcement learning / RL for finance: for strategy design, portfolio rebalancing, hedging

- Interpretability & explainable ML: SHAP, LIME, model risk controls

Production & MLOps Layer

- Model deployment: APIs, model serving, containers (Docker), microservices

- Versioning & monitoring: model version control, drift detection, alerts

- Performance & latency tuning: optimizing inference time, memory footprint

- Scalable infrastructure: cloud platforms (AWS, GCP, Azure), stream or batch processing

- Governance & compliance: audit trails, documentation, model risk frameworks

Each layer builds on the previous. You don’t need perfect mastery up once — but having working competence across all is the hallmark of a true AI Finance Engineer.

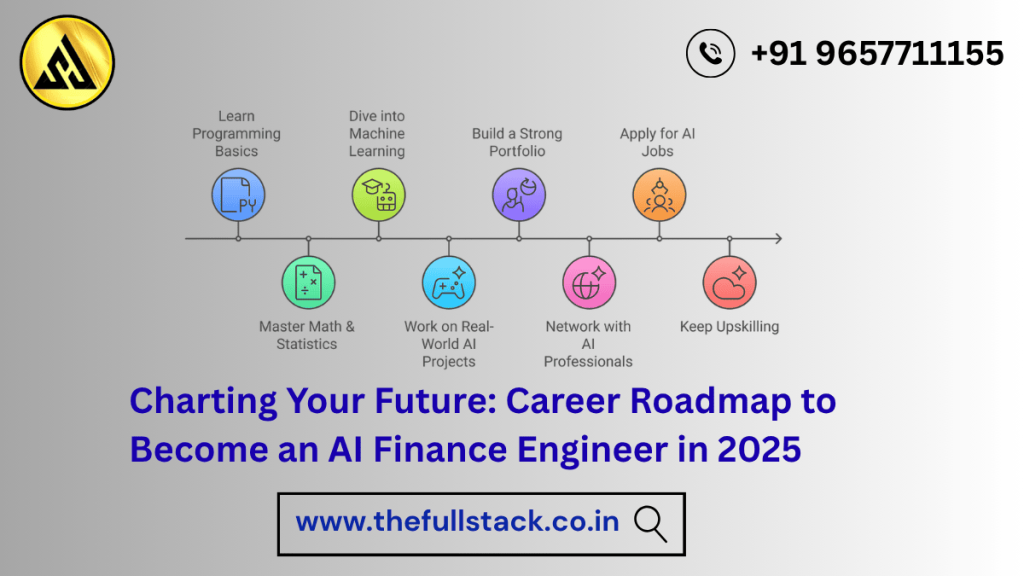

Roadmap: Phased Journey to 2025

Below is a suggested timeline you can follow over ~12 to 24 months, depending on your pace and prior experience. Adjust as needed to your schedule.

Phase 1: Foundation & Discovery (Months 1–4)

- Refresh / learn Python and data manipulation

- Dive into math & statistics (linear algebra, probability, hypothesis tests)

- Begin basic finance coursework: learn financial instruments, market structure

- Build your first micro-project: e.g. backtest a moving average crossover strategy

- Start reading research blogs / papers at the intersection of ML & finance

Deliverable by Month 4: A simple backtesting script + report on performance vs baseline.

Phase 2: Core Models & Proofs of Concept (Months 5–9)

- Implement ML models on financial data (regression, classification, clustering)

- Work with time series methods (ARIMA, GARCH)

- Introduce deep sequence models (LSTM, attention)

- Build feature engineering pipelines on raw financial data

- Launch your POC: e.g. predict next-day returns or anomaly detection in transactions

Deliverable by Month 9: A small model + evaluation, documented notebooks, comparison vs baseline.

Phase 3: Advanced Strategy & Hybrid Techniques (Months 10–15)

- Explore reinforcement learning / policy gradients applied to financial decisions

- Hybrid model design: combining classical quant models + neural augmentations

- Incorporate risk constraints, transaction costs, portfolio constraints

- Stress tests, walk-forward validation, regime switching

- Optimize your model: hyperparameter tuning, feature selection

Deliverable by Month 15: A POC that can simulate simple strategy returns over a test period, with evaluation metrics and sensitivity analysis.

Phase 4: Production Readiness & Deployment (Months 16–24)

- Containerize your model (Docker) and build a serving API

- Integrate into a simple front-end or dashboard for visualization

- Implement model monitoring, drift detection, retraining pipelines

- Ensure logging, version control, governance standards

- Prepare a real or simulated deployment within a domain (e.g. paper trading)

Deliverable by Month 24: A deployed AI finance prototype (even if simulation) that can handle real-time or near-real-time inputs, with monitoring dashboards.

Real-World Insights & Relatable Examples

Real-World Example: Credit Scoring with Neural Augmentation

A bank maintains a classical credit scoring model using logistic regression. As an AI Finance Engineer, you enhance this with an embedding-based neural network component that captures applicant behavior over time (e.g. payment trends). Combined, the hybrid model improves default prediction by 8% and reduces false positives — thus saving costs while managing risk.

Real-World Example: Reinforcement Learning for Portfolio Rebalancing

You can set up an RL agent that, every rebalance period (e.g. daily or weekly), chooses portfolio weights considering transaction cost and expected returns. The reward function penalizes excessive turnover and rewards Sharpe ratio improvements. In simulation, the RL strategy outperforms static allocation.

These are not just “exotic ideas” — several research groups and quant firms are actively exploring such pipelines.

Tips for Staying Motivated & Avoiding Burnout

- Break tasks into weekly goals: finish a notebook, get a model to run, test a hypothesis

- Celebrate small wins: a 1% improvement in error, a cleaned dataset, a working API

- Read only 1–2 research papers per week and extract one idea you can test

- Join communities: AI finance Discords, quant meetups, Kaggle, open-source projects

- Document your learning: write blog posts, share notebooks; teaching helps retain

- Balance theory and practice: alternate between reading and coding

- Be patient: the domain is complex; consistent effort compounds

Why You Should Do This — For You & For Your Organization

For Individual Learners

- You gain a rare, high-value skill at the overlap of AI + finance

- You can build a strong portfolio that signals domain depth and technical strength

- As AI permeates finance, you become future-proof and competitive

For Company Employees & Teams

- You can spearhead in-house AI/ML integration in trading desks, risk, or analytics

- You can bridge communication between quant researchers and software engineers

- Your leadership in AI compliance, model risk, and deployment can accelerate innovation

Call to Action: Your Next Step Toward Mastery

You don’t need to wait until tomorrow. Take your first step today.

We’ve built structured courses, bootcamps, and labs precisely to support your journey to becoming an AI Finance Engineer:

- AI Finance Foundations — core modules on quant basics, ML & finance

- Hands-On Labs — build mini-projects in Python with financial datasets

- Deployment & MLOps Course — learn how to put your models into production

- Mentorship & Capstone Projects — guided by industry experts to build real systems

- Corporate Upskill Programs — for teams aiming to adopt AI finance internally

👉 Visit our “Career Paths” or “Advanced Learning” page now and enroll in the next batch of courses. Dive in gradually, stay consistent, and within a year or two, you’ll be on that roadmap to 2025—or beyond—building the financial AI systems others envy.

Your domain knowledge, logical mindset, and willingness to learn will take you far. Start small, build steadily, and let your portfolio and results speak. The future of finance is algorithmic — and there’s a seat waiting for you.

What is AWS Lambda?A Beginner’s Guide to Serverless Computing in 2025

Java vs. Kotlin: Which One Should You Learn for Backend Development?