Reinforcement Learning Meets ESG Trading: Profit with Sustainability

Sustainable investing is no longer just a trend—it’s a global movement. Investors, companies, and financial institutions are increasingly prioritizing Environmental, Social, and Governance (ESG) factors while making decisions. But how can you maximize profits while staying committed to sustainability? Enter Reinforcement Learning (RL)—a type of artificial intelligence that can learn optimal trading strategies through trial and error.

This beginner-friendly guide explains how reinforcement learning meets ESG trading, why it matters, and how you can start incorporating it into investment strategies. Whether you are a general reader, company employee, or aspiring trader, you’ll walk away with practical insights to make informed, sustainable, and profitable decisions.

What Is Reinforcement Learning?

Reinforcement Learning (RL) is a branch of AI where an agent learns to make decisions by interacting with an environment. The agent performs actions, receives feedback (rewards or penalties), and gradually improves its strategy.

Think of it as training a smart investor: the AI tries various investment strategies, sees which actions lead to positive outcomes, and refines its approach over time. Unlike traditional machine learning, RL does not require pre-labeled data; it learns through experience.

What Is ESG Trading?

ESG trading focuses on investing in companies with strong environmental, social, and governance practices. ESG factors might include:

- Environmental: Carbon emissions, renewable energy usage, and waste management.

- Social: Employee welfare, diversity initiatives, and community impact.

- Governance: Ethical management, board diversity, and transparency.

Investors increasingly favor companies that prioritize ESG, creating a financial incentive for sustainability. Combining this with AI opens new avenues for profitable, responsible trading.

How Reinforcement Learning Enhances ESG Trading

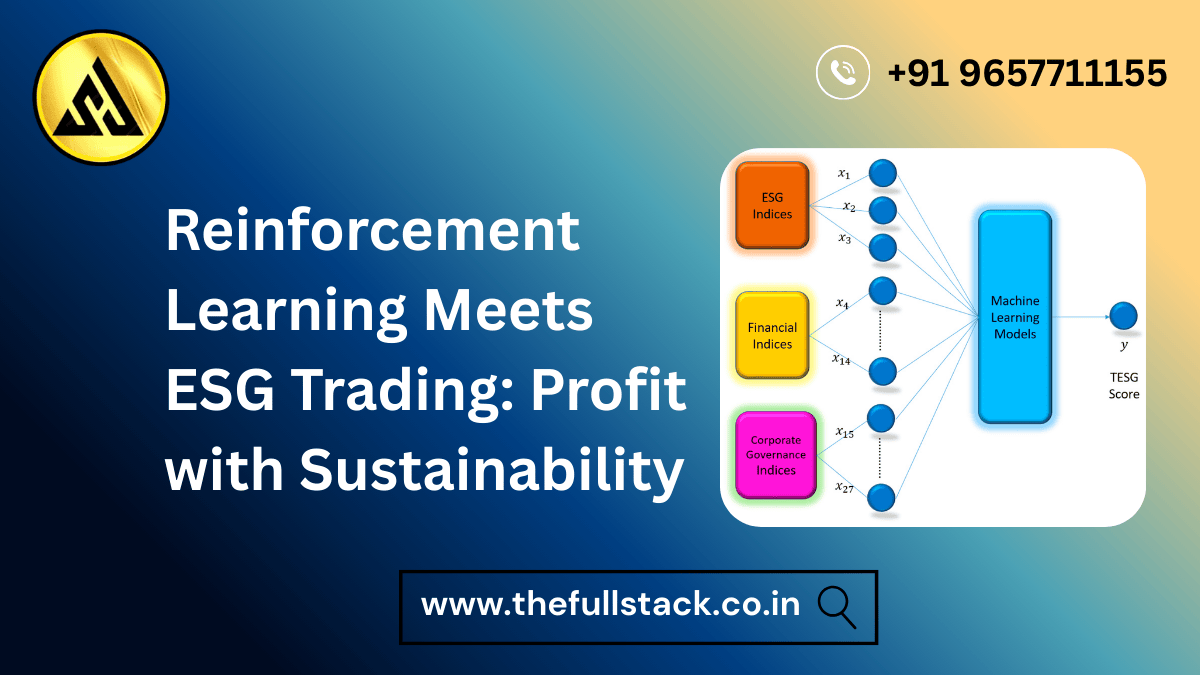

Reinforcement Learning can revolutionize ESG trading in several ways:

- Dynamic Decision-Making: RL models adapt to real-time market conditions while considering ESG factors.

- Portfolio Optimization: RL agents can balance risk and returns, ensuring sustainable investments do not compromise profits.

- Scenario Simulation: RL can test different market scenarios, helping investors anticipate ESG-driven market shifts.

- Data-Driven Insights: Integrates ESG scores, financial metrics, and global trends to make smarter trading decisions.

Example: An RL agent may favor companies with high ESG scores in a volatile market while avoiding low-score companies, maximizing long-term returns without compromising sustainability goals.

Benefits of Reinforcement Learning in ESG Trading

- Profitability with Purpose: Align investments with ethical and sustainable goals.

- Adaptive Strategies: Responds to market changes and ESG score updates in real time.

- Risk Reduction: Avoids exposure to companies with poor ESG practices, reducing potential controversies.

- Scalability: Can handle portfolios of any size, from individual investors to institutional funds.

- Enhanced Decision Support: Provides actionable insights for both beginners and professionals.

Real-World Applications

- Sustainable ETFs: RL can select ESG-compliant stocks for exchange-traded funds.

- Corporate Portfolio Management: Companies can invest in ESG-focused assets while maximizing ROI.

- Impact Investing: RL identifies opportunities that generate measurable environmental and social impact.

- Hedge Funds: Institutional investors can use RL to incorporate ESG metrics into complex trading strategies.

Beginner-Friendly Tips

- Start Small: Begin with ESG ETFs or small portfolios while exploring RL insights.

- Understand ESG Scores: Learn how companies are evaluated and how it affects investment decisions.

- Combine AI and Human Judgment: Reinforcement Learning enhances decision-making but does not replace human oversight.

- Diversify Portfolio: Balance ESG investments with traditional assets for long-term stability.

- Invest in Learning: Attend courses or workshops on RL and sustainable investing to strengthen your knowledge.

Beginner-Friendly Scenario

Suppose an RL agent is managing a portfolio and receives updates about two companies:

- Company A: Strong ESG practices, moderate financial growth.

- Company B: High financial growth but poor ESG rating.

The RL model evaluates potential long-term risks and rewards, simulates market scenarios, and recommends a strategy that favors sustainable profits—possibly investing more in Company A while reducing exposure to Company B.

Even beginners can leverage these insights to trade responsibly while protecting long-term returns.

Market Trends and Industry Insights

- Sustainable Investing is Growing: Global ESG investments have reached trillions of dollars and continue to rise.

- AI Adoption in Finance: More hedge funds and investment firms are implementing RL for smarter trading.

- Retail Access: Beginner-friendly platforms are integrating ESG data with AI analytics.

- Regulatory Support: Governments are incentivizing sustainable investments, making ESG trading more mainstream.

Why It Matters

Integrating Reinforcement Learning with ESG trading is not just about profits—it’s about future-proof investing. It allows traders to:

- Adapt to fast-changing markets

- Make ethical investment decisions

- Maximize long-term returns

- Reduce exposure to risks from unsustainable companies

For beginners and professionals alike, this approach represents a smarter, more responsible way to invest.

Call-to-Action

The future of trading combines intelligence with sustainability. Reinforcement Learning empowers investors to profit while promoting responsible corporate behavior.

👉 Explore our advanced courses on AI-driven ESG trading to learn how to optimize your portfolio, minimize risk, and make a positive impact on the world.

You may be interested in:

Data Visualization In Data Science: Tools, Best Practices-2025

Leave a Reply